In our previous post we talked about giving in to the temptation of buying a gadget just because it is on sale. I suggested a self-test everyone should make before considering a purchase of anything that's on sale:

Ask yourself this: Would you still buy the gadget if it wasn’t on sale? If the answer is yes, then you might have a legitimate reason that the item is what you really need. If the answer is no, go back home and forget about the impulsive shopping moment.

Today, I want you to consider the story of George.

George was at his favorite music store, having dragged along his buddy Mike just to check things out. Both snooped around the store and saw that there was this keyboard on sale at 20% off the suggested retail price. The original price was $1000, so George assumed 20% off would save him $200. Now that the sale was on, George remembered he always wanted a keyboard, even though he’s really a guitar player...

George did not have anything close to $1000 or even $800 in cash but he had a credit card and figured he could always just pay off say $40 each month by working an extra hour each week at his part-time job. At $200 off, that keyboard looked and sounded really really tempting. Should he go ahead and buy it on credit now while it's still on sale?

George, still a student at a music college, did not have a steady job so his income fluctuated quite a bit. Since he hadn't been too good at paying his monthly bills on time, his credit score wasn't the best either. As a result, the credit card company charged him a very high interest of 29% on his outstanding balance.

With that in mind, Mike pulled George aside and rattled his head around a few times saying: "Wake up George", he said. "Do you realize how long it will take you to pay off the credit card balance?" Mike, who loved math, pulled out his iPod remembering he just recently downloaded a finance app. He punched in the following numbers:

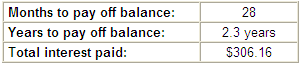

Hit the enter button and nearly chocked when he saw this:

That keyboard “on sale” almost turned out to be an expensive and painful lesson if Mike hadn't checked things on his finance app. Not only would it take him more than 2 years to pay off the keyboard, it would end up costing George $1,106.16 ($800+$306.16 interest) – not much of a sale after all...

Lesson learned

A 20% discount can easily turn into a huge surcharge if you buy things on credit. Always think twice and do your math before you buy anything on credit!

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com

No comments:

Post a Comment