Sunday, December 5, 2010

Tis the Season...

Wednesday, October 20, 2010

Creativity & Finance

Some of those creative minds must have gone into banking and financial services. It is rather apparent how "creative" the financial services industry has become - creative in terms of finding new ways to circumvent new rules and to "milk" consumers. Today's Wall Street Journal has a good example of how some companies have become adapt at finding loopholes. Please consider: Fed Aims to Tighten New Rules for Credit

As the article notes:

The proposed rules also address fees frequently tacked onto cards marketed to people with weaker credit histories. The credit-card law, targeting confusing offers that often drew lower-income customers to sign up for costly credit, limited fees to no more than 25% of a card's credit line in the first year.Whether you are a musician, an artist or any other consumer, you have to watch out. Creativity is great in music and in art, but it can have its downside when you let bankers get a hold of creative thinking.

First Premier Bank has since offered a card with a $300 credit limit and $75 annual fee, plus a $95 processing fee that must be paid before the card is used. The bank, which didn't respond to requests for comment, told The Wall Street Journal earlier this year that the 25% limit only applied to fees charged after an account was opened.

Perhaps it's time to switch roles and have artists put on a banker's head for a change. That analytical mind would do them well and should keep them away from ridiculous terms as described above. Don't forget it's your money. Don't let these credit sharks get a hold of it!

Friday, October 8, 2010

A Spending Diary

How about using the same premise to "Watch what you spend"?

We have an easy one-page work sheet that you can use as a budgeting tool to track where your money is going. You are far more likely to save money when you see how fast the small things that you buy here and there can add up.

Click on the image below to see the full-size work sheet...

The best way to do this on a regular basis is to combine if with another daily routine e.g. brushing your teeth. While you brush your teeth, do a mental recap of your daily expenses. This helps you remember where your money went. But make sure you write down what you spent immediately after brushing your teeth. You should include everything, even the dimes and nickels!

After a month of tracking your expenses, go over the completed sheets and try to figure out where you spent too much money on by evaluating each expense.

As they say, seeing is believing. Once you actually see where your money goes you may be shocked to find a number of items that were unnecessary, perhaps frivolous expenses. But you have made the first step in getting a better grip at your finances.

Keep the exercise going; this will help you later on in establishing and maintaining your own personal budget.

If you would like a printable version (PDF file) of our work sheet please email: clemens.kownatzki@fxistrategies.com

Monday, October 4, 2010

Don’t Forget: Your Bank Controls The Rates!

When you examine the rates of loans, foremost the credit card financing rates, you will notice that those rates are always a lot higher than savings rates for example. That difference is even more evident when the general interest rates are as low as they are now. At present, you might get only as much as 1% interest on your savings whereas credit cards usually have financing rates of 20% or more. Quite a difference...

This leads us to an important concept in the world of finance. Without exception, the financial institutions that hold "YOUR MONEY", i.e. your bank, credit card provider or broker, create terms that work in their favor rather than in yours. Therefore, the interest you receive on your savings will never be anywhere as high as the rates charged for a loan. The difference between receiving and paying interest from the bank's point of view is easy profit. Sadly, that is not is something the banks are willing to give up for your sake.

It is therefore immensely important that you always read and understand the terms and conditions your bank is offering for their services. You too do not want to give up part of your money so that banks can make even bigger profits.

Wednesday, September 1, 2010

Einstein’s Advice

You can use the Rule of 72 to quickly estimate how many years it takes to double your money at a given interest rate. Albert Einstein, one of the most famous scientists of modern times, loved the Rule of 72 and referring to compound interest, is quoted as saying:

"Compound interest is the greatest mathematical discovery of all time"

If you can remember E = mc² you should be able to remember this:

72 ÷ interest rate = # of years to double your moneyRemember, this formula is an approximation not 100% accurate, but pretty close. If you’d like to calculate numbers to the nearest cent, here’s the actual compound interest formula:

Example: 72 ÷ 10 (%) = 7.2 (years)

$1,000 invested at 10% would take 7.2 years to grow to $2,000

Pn = P0 (1+r)n

Where,

Pn = Future Value

P0 = Present Value or Principal

r = interest rate (per year)

n = time (in years) a.k.a. compounding periods

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com

As always, please help us spread the word and promote financial literacy!

Tuesday, August 24, 2010

Learning the Rule of 72

In Finance, the Rule of 72 is equally powerful and it too can be used when everything else fails.

This is our first post on learning the rule of 72, considered by many finance gurus as one of the most essential rules of personal finance that you can apply in your daily lives.

The rule of 72 is widely known as a quick way to compute the doubling time of an investment.

Here’s how it works:

Take the number 72 divide it by the interest rate to find out the number of years it takes to double your initial investment at that given rate. The formula looks like this:

72 ÷ i (interest rate) = y (years)

For example, the rule of 72 states that $100 invested at 10% would take 7.2 years to double.

72 ÷ 10 (%) = 7.2 (years)

The rule of 72 also works in another way. If you want to know how much of a return you need to double your investment in say 10 years, the calculation works like this:

72 ÷ 10 (years) = 7.2 (%)

We will have many opportunities to use this rule using all kinds of examples. For now, just remember:

72 ÷ interest rate gives you the years you need to double your money.

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com

Please help us spread the word and promote financial literacy!

Thursday, June 17, 2010

Think Twice Before Buying On Credit

In our previous post we talked about giving in to the temptation of buying a gadget just because it is on sale. I suggested a self-test everyone should make before considering a purchase of anything that's on sale:

Ask yourself this: Would you still buy the gadget if it wasn’t on sale? If the answer is yes, then you might have a legitimate reason that the item is what you really need. If the answer is no, go back home and forget about the impulsive shopping moment.

Today, I want you to consider the story of George.

George was at his favorite music store, having dragged along his buddy Mike just to check things out. Both snooped around the store and saw that there was this keyboard on sale at 20% off the suggested retail price. The original price was $1000, so George assumed 20% off would save him $200. Now that the sale was on, George remembered he always wanted a keyboard, even though he’s really a guitar player...

George did not have anything close to $1000 or even $800 in cash but he had a credit card and figured he could always just pay off say $40 each month by working an extra hour each week at his part-time job. At $200 off, that keyboard looked and sounded really really tempting. Should he go ahead and buy it on credit now while it's still on sale?

George, still a student at a music college, did not have a steady job so his income fluctuated quite a bit. Since he hadn't been too good at paying his monthly bills on time, his credit score wasn't the best either. As a result, the credit card company charged him a very high interest of 29% on his outstanding balance.

With that in mind, Mike pulled George aside and rattled his head around a few times saying: "Wake up George", he said. "Do you realize how long it will take you to pay off the credit card balance?" Mike, who loved math, pulled out his iPod remembering he just recently downloaded a finance app. He punched in the following numbers:

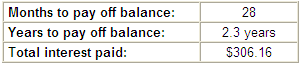

Hit the enter button and nearly chocked when he saw this:

That keyboard “on sale” almost turned out to be an expensive and painful lesson if Mike hadn't checked things on his finance app. Not only would it take him more than 2 years to pay off the keyboard, it would end up costing George $1,106.16 ($800+$306.16 interest) – not much of a sale after all...

Lesson learned

A 20% discount can easily turn into a huge surcharge if you buy things on credit. Always think twice and do your math before you buy anything on credit!

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com

Wednesday, June 16, 2010

The Lure Of “On Sale” Items

We have all been there - Browsing through your favorite store and you see that big red tag:

Sometimes you see a huge sign right in front of the store inviting you to come in and “save”

Who wouldn’t want to save money and get some new music gear at the same time?

As luck would have it, that new gizmo you previously looked at with a bit of disdain looks a whole lot better now with the “20% Off Sticker” attached to it. Isn’t it strange how a “soso”, “just ok”, “maybe yes” piece of gear now becomes more like a must have item? And the only difference being the advertized sale price?

Well, let’s dispel some myths here...

First off, the word “savings” is a complete misnomer in the context of advertising. The only way for you to “save money” is to not spend it. Put your money in a piggy bank or open a savings account – that is saving. When you go shopping, you may pay a lower price on a sale item, but you are definitely not saving.

Second, prices always change buying behavior, there’s simply no way around it. But instead of letting your impulses give in, ask yourself this: Would you still buy the gadget if it wasn’t on sale? If the answer is yes, then you might have a legitimate reason that the item is what you really need.

If the answer is no, go back home and practice your favorite solos, arpeggios or chord progression. That will definitely save you some money.

Thursday, May 13, 2010

How To Get $1 Million

The task seems daunting, almost unreachable for many of us. "If you could only have a Million Dollars what would you spend it on?" that is the sort of mind games most of us have been playing at some point in our lives. How realistic is the goal of becoming a millionaire?

Whether you work as a musician, painter, banker or accountant, the goal is indeed reachable. If you start saving and investing early and you plan wisely, it does not appear such an unrealistic goal after all.

Let's use an example to show you that the illusive $1 Million target is not all that unattainable:

If you can save about $10,000 this year and then invest another $10,000 each year at a compounded interest of 7%, you could reach that goal in about 30 years.

If you can save about $20,000 this year and then invest another $20,000 each year at a compounded interest of 7%, you could reach that Million Dollar goal in only 20 years.

Sounds unreal? Not at all – it’s all about planning. There are numerous online calculators that can help you do these types of long-term financial goal settings. Send me an email to clemens.kownatzki@fxistrategies.com to get your own personal savings goal calculator.

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com

Please help us spread the word and promote financial literacy!

Friday, April 30, 2010

Good Money Habits That Work: Living Below Your Means

To meet some role models for the notion of living well within your means, please consider this insightful article: Five Billionaires Who Live Below Their Means.

Topping the list is Warren Buffett, one of the wealthiest self-made billionaires and also one of the most successful investors of our time. Mr. Buffett is the most un-assuming, low profile person you could ever meet. As legend goes, he still lives in the same house he bought decades ago for only $31,500. How is that for an example of dealing with real-estate bubbles.

Mr. Buffet may be the epitome of the "living below your means" school of thought and he may have taken things to an extreme. But the lesson is clear: Spending less than you earn could be the single most important habit ensuring a sound financial future.

Wednesday, April 28, 2010

New Credit Card Rules & The Time Value Of Money

Every now and then, governments implement useful new regulations. It was the case when Tobacco companies were required to put health risk warnings on all their products and advertisements and here is another one which has been long overdue IMHO. The Federal Reserve's new rules for credit card companies mean greater protections for consumers. On their Website, the Federal Reserve lists some key changes you should expect from your credit card company beginning on February 22, 2010.

There are various new rules which all make sense in terms of limiting the shark-like behavior of some of the more notorious credit card companies. Perhaps the most relevant changes that could affect you positively are the new rules for late payments and minimum payments.

Have you looked at your credit card statement recently? The first page should now look something like this:

The prominent displays of late payment and minimum payment warnings should provide some deterrent for all of us credit hungry musicians.

As an exercise, hopefully creating some form of an “aha” effect, use the 2 examples above to truly understand the difference of paying something today versus delaying payment. This is a perfect illustration of the time value of money, a concept we will be spending a lot of time with in the future. Meanwhile, take out your calculators and run through some calculations.

You can also see a great cartoon on the subject at our previous post Funny Money.

As we concluded then, it’s always best to pay off your credit card balance in full!

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com

Please help us spread the word and promote financial literacy!

Tuesday, April 27, 2010

Funny Money, the fun site to learn about money

This is an excellent concept I just came across: Funny Money is a website based in Canada using cartoons and interactive tools to teach kids and about basic concepts of money. As they put it: North America's #1 fun-ancial seminar.

Please check out this excellent cartoon: Get it on Credit

The cartoon teaches you some basics about credit cards. While being entertained they also learning about credit cards, payment terms, compound interest and credit scores.

Enjoy the cartoon and remember to pay off your credit card balance in full!

|

Saturday, April 10, 2010

Why Teach Basic Finance Skills To Musicians?

The study also suggests, among many other alarming trends, that younger individuals display a much lower financial literacy than older individuals.

Source: Financial Capability in the United States. FINRA Investor Education Foundation, December 2009

Many musicians, particularly the younger and upcoming talents, are somewhat clueless when it comes to handling their own personal finances. This needs to change - now more so than ever that tougher economic times are looming upon us all.

Financial literacy is not an art form nor is it an innate ability or talent. Most of the concepts of understanding finance are based on simple math skills (Middle School level) and a bit of common sense, all of which can be taught at any age. These fundamental skills need to be taught and practiced just as a musician would need to practice many years before embarking on a career in music.

A musician needs to build up the motor skills as well as the musical understanding and likewise do students need to learn, understand, and practice basic financial skills to better manage their personal finances. Here's a simple rule: It's not how much you make but how much you keep that defines your financial future!

Most importantly, by teaching musicians (and artists in general) to understand their own personal financial situation and enabling them to live within their financial means, we can elevate a much larger group of musicians to the ranks of “working musicians” and “working artist”. All those musicians who would otherwise be forced to wait tables or work odd jobs could devote much more time towards developing their craft. Music and art in general might experience a whole new renaissance.

Please help us spread the word and promote financial literacy!

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com

Wednesday, March 31, 2010

"Money 101" For Musicians - A New Site Is Born

This site is devoted to promoting financial literacy among musicians, artists and supporters of the arts in general. It also serves as a sounding board for programs, projects, tools, resources. We welcome an open discussion and are looking for contributors to share insights and information.

The only way for the arts to survive and prosper in these critical economic times is to create financially literate and self-supporting musicians and artists.

Please help us spread the word and promote financial literacy.

For questions, comments and suggestions, please feel free to use the commentary section or email: clemens.kownatzki@fxistrategies.com